When a surgeon schedules an operation, the last thing a patient wants to hear is that the insurer is refusing to pay. Insurance surgery denial can stall treatment, raise out‑of‑pocket costs, and cause a lot of stress. Below you’ll discover the main reasons insurers say ‘no’, how to spot the red flags early, and what steps to take when you need to fight the decision.

Key Takeaways

- Denials usually fall into five buckets: lack of medical necessity, missing pre‑authorization, policy exclusions, out‑of‑network issues, and documentation errors.

- Collecting the right paperwork before the claim is filed can prevent 70% of common denials.

- Most insurers have a formal appeal process; timing and a clear medical justification are critical.

- Patient advocacy groups and state regulators can help when an appeal stalls.

What Triggers an Insurance Surgery Denial?

Insurers evaluate each surgery claim against the terms of the policy that defines what is covered, what isn’t, and under which conditions coverage applies. When a claim deviates from those rules, the insurer issues a denial. The most frequent triggers are:

- Lack of medical necessity: The insurer’s reviewer decides the procedure isn’t essential for health, often because the supporting documentation doesn’t link the diagnosis to the surgery.

- Missing or invalid pre‑authorization: Many plans require a formal pre‑authorization before the surgeon can book the operating room. Without it, the claim is automatically rejected.

- Policy exclusions: Certain surgeries-cosmetic, experimental, or elective-may be listed as exclusions in the policy document.

- Out‑of‑network provider: If the surgeon or hospital isn’t in the insurer’s network, the claim may be denied or reimbursed at a lower rate.

- Documentation errors: Incorrect CPT codes, missing diagnosis codes, or mismatched dates can trigger an automatic denial.

Deep Dive into the Top Five Denial Reasons

Understanding each reason helps you pre‑empt the problem.

| Denial Reason | Why It Happens | How to Prevent It |

|---|---|---|

| Lack of medical necessity | The insurer’s medical reviewer doesn't see a direct link between diagnosis and surgery. | Ask your surgeon to provide a detailed letter, include imaging reports, and reference clinical guidelines (e.g., NICE, AHA). |

| Missing pre‑authorization | Provider failed to submit the required form before the scheduled date. | Confirm pre‑auth requirement early; have the office submit the form and obtain the approval number. |

| Policy exclusions | The procedure is categorized as cosmetic, experimental, or elective. | Review the policy’s exclusion list; if the surgery is essential, request a medical exception. |

| Out‑of‑network provider | Surgeon or facility not contracted with the insurer. | Verify network status; if out‑of‑network is unavoidable, request a negotiated rate or a prior‑auth for out‑of‑network coverage. |

| Documentation errors | Incorrect CPT code, missing diagnosis (ICD‑10) code, or mismatched dates. | Double‑check the claim form; have the billing office run a compliance check before submission. |

How to Build a Denial‑Proof Claim Packet

Think of a claim packet as a mini‑case file you would present to a judge. The stronger the evidence, the less likely the insurer will say no.

- Medical necessity letter: Written by the surgeon, citing the specific diagnosis, severity, and why the surgery is the only viable option.

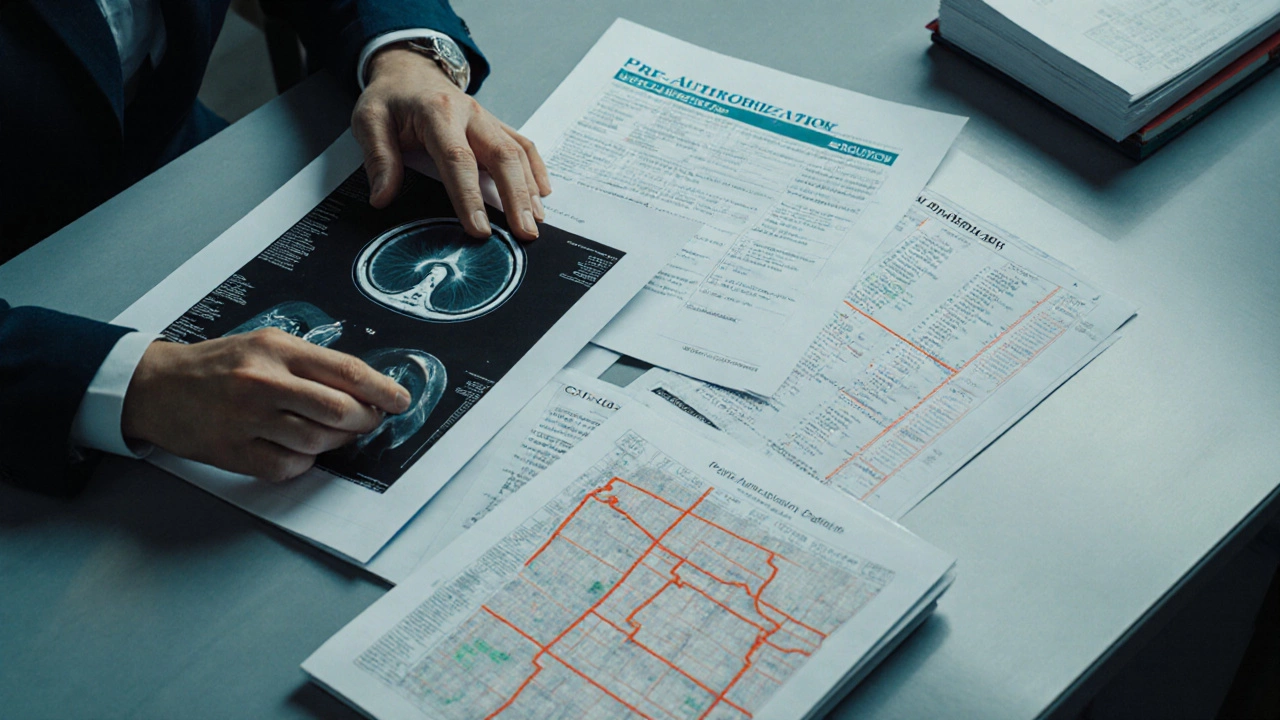

- Diagnostic imaging: Include the latest MRI, CT, or X‑ray images with radiologist reports that support the surgical recommendation.

- Clinical guidelines: Reference nationally‑accepted guidelines (e.g., American College of Surgeons) that endorse the procedure for the diagnosed condition.

- Pre‑authorization confirmation: Attach the approval number, date, and a copy of the insurer’s acknowledgment.

- Accurate coding: List the CPT code for the surgery, the corresponding ICD‑10 diagnosis code, and any modifier codes required.

- Insurance policy excerpt: Highlight the section of your plan that shows coverage for the procedure, if applicable.

When the packet arrives at the insurer’s medical reviewer, they can quickly verify compliance without having to request additional information-a common cause of delays.

Appealing a Denial: Step‑by‑Step Process

If a claim is still denied, don’t panic. Most insurers have a structured appeal workflow.

- Read the Explanation of Benefits (EOB): The Explanation of Benefits outlines the exact denial code. Write the code down; you’ll need it for the appeal.

- Gather supporting documents: Use the denial‑proof packet plus any new evidence (e.g., a second opinion).

- File the internal appeal: Most insurers require a written appeal within 30 days of the EOB. Include the original denial code, a clear statement that you disagree, and the supplemental evidence.

- Escalate to external review: If the internal appeal fails, you can request an independent third‑party review, often mandated by state law.

- Involve a patient advocate: Organizations such as the Health Care Rights Foundation can intervene on your behalf, especially for complex cases.

Key tip: keep a timeline. Note every phone call, email, and mailed document with dates. A well‑documented timeline can be decisive if the dispute reaches a regulator.

Common Pitfalls and How to Avoid Them

- Assuming coverage: Even if you’ve paid premiums for years, each new surgery triggers a separate eligibility check.

- Waiting too long to verify: Some policies change annually. Verify your coverage within 60 days of scheduling.

- Relying on verbal assurances: Get everything in writing-pre‑auth numbers, network status, and coverage confirmations.

- Skipping the second opinion: A second surgeon’s note can reinforce medical necessity, especially for borderline cases.

- Ignoring state‑specific rules: In Ireland, the Health Insurance Act 2015 sets minimum coverage standards. Know your rights under local law.

Resources for Patients Facing a Denial

When you’re stuck, these tools can help you move forward:

- National Patient Advocacy Network: Offers templates for appeal letters and free consultation.

- State Insurance Commissioner’s Office: Handles complaints about unfair denial practices.

- Health Insurance Transparency Portal: Lets you compare policy exclusions across major insurers.

- Legal aid clinics: Some provide pro‑bono services for denied medical claims.

Remember, a denial isn’t the final word-it’s a hurdle you can overcome with the right paperwork and persistence.

Frequently Asked Questions

What does “medical necessity” mean for surgery coverage?

Medical necessity indicates that the surgery is required to treat a diagnosed condition, prevent a serious health decline, or improve function. Insurers compare the claim against clinical guidelines and the patient’s medical record to decide if the procedure qualifies.

How long do I have to appeal a denial?

Most plans give you 30 days from the date on the Explanation of Benefits to submit an internal appeal. Some states extend this window, so check the policy’s fine print.

Can I get coverage if my surgeon is out‑of‑network?

It depends on your plan’s out‑of‑network benefits. You may need a special prior‑authorization and may be responsible for a higher coinsurance. Some insurers will cover it if there’s no in‑network alternative.

What is a CPT code and why does it matter?

CPT (Current Procedural Terminology) codes uniquely identify medical services. Using the correct CPT code ensures the insurer knows exactly which surgery you’re billing for; a wrong code often triggers an automatic denial.

Should I involve a lawyer for a denied surgery claim?

If the internal and external appeals fail, legal counsel can help you sue for breach of contract or unfair claims practices. Many lawyers work on a contingency basis for medical claim cases.