Medicare Premium Calculator

Estimated Premiums

If you’re on Medicare and worried about rising premiums, you’re not alone. Many people assume Medicare is free after paying taxes for decades - but that’s not true. For most, Part B (which covers doctor visits and outpatient care) and Part D (which covers prescriptions) come with monthly premiums. And if your income is above a certain level, you pay even more. The question isn’t just what is the income limit to not pay Medicare premiums - it’s when do you start paying extra?

Medicare premiums aren’t the same for everyone

Medicare Part B has a standard monthly premium of $185 in 2026. But if your income is higher than the threshold, you pay more. This extra charge is called the Income-Related Monthly Adjustment Amount, or IRMAA. It’s not a penalty. It’s a sliding scale based on your tax return from two years ago. So if you’re filing taxes in 2026, Medicare uses your 2024 income to decide your 2026 premium.There’s no income level where you pay $0. Even people with low income still pay something - but they might qualify for help. The real question is: when does your premium jump above the standard rate? That’s where the IRMAA brackets come in.

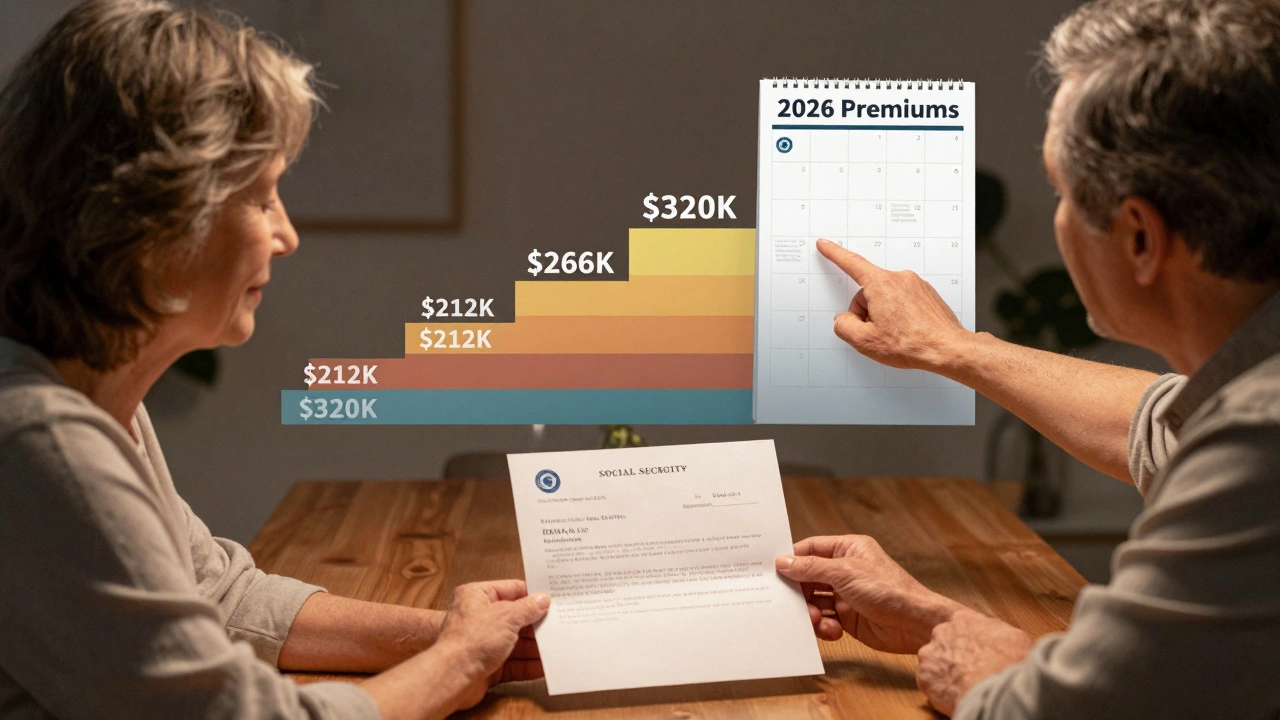

2026 Medicare IRMAA income thresholds

The income limits are based on your Modified Adjusted Gross Income (MAGI), which includes wages, pensions, investment income, and even tax-exempt interest. These thresholds are different for single filers and married couples filing jointly.Here’s what the 2026 IRMAA brackets look like:

| Filing Status | Income Threshold | Part B Monthly Premium | Part D Monthly Premium |

|---|---|---|---|

| Single | $106,000 or less | $185 | $0-$12.90 |

| Single | $106,001-$133,000 | $259 | $12.90-$20.00 |

| Single | $133,001-$160,000 | $370 | $20.00-$31.00 |

| Single | $160,001-$500,000 | $481 | $31.00-$42.00 |

| Single | $500,001 or more | $559 | $42.00-$53.00 |

| Married Filing Jointly | $212,000 or less | $185 | $0-$12.90 |

| Married Filing Jointly | $212,001-$266,000 | $259 | $12.90-$20.00 |

| Married Filing Jointly | $266,001-$320,000 | $370 | $20.00-$31.00 |

| Married Filing Jointly | $320,001-$750,000 | $481 | $31.00-$42.00 |

| Married Filing Jointly | $750,001 or more | $559 | $42.00-$53.00 |

Notice something important? The standard premium kicks in at $106,000 for singles and $212,000 for couples. If you earn less than that, you pay the base rate. Once you go over, your premium increases in steps - not all at once. The highest bracket is for those earning over $500,000 (single) or $750,000 (joint). Most people never reach that level.

What counts as income for Medicare?

It’s not your take-home pay. Medicare uses your Modified Adjusted Gross Income from your IRS tax return. That includes:- Wages and self-employment income

- Interest and dividends

- Rental income

- Pensions and retirement distributions

- Tax-exempt interest (like from municipal bonds)

- Foreign income

It does NOT include Social Security benefits themselves. That’s a common mistake. Even if your only income is Social Security, you won’t pay IRMAA - unless you have other sources like investment income or a part-time job.

Also, IRMAA is based on your tax return from two years ago. So if you retired in 2025 and your income dropped sharply, Medicare won’t know until 2027. That can cause a problem - you’re stuck paying higher premiums for a year or two even though you’re no longer earning that much.

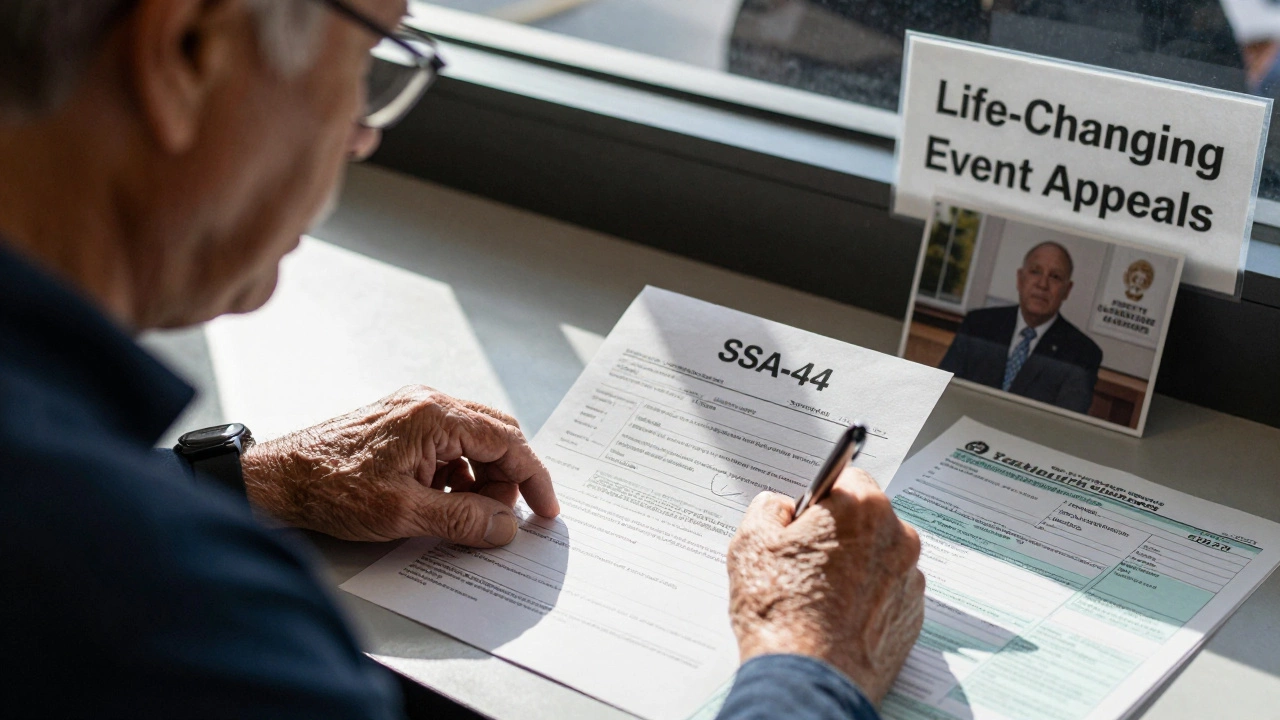

What if your income dropped? You can appeal

If you had a major life change - retirement, death of a spouse, divorce, loss of income, or loss of pension - you can ask Medicare to use a more recent income number. This is called a life-changing event appeal.You don’t have to wait for your next premium bill. File Form SSA-44 with the Social Security Administration as soon as your income drops. You’ll need to provide proof: a copy of your 2025 tax return, a letter from your employer, or a death certificate. Once approved, your premium adjusts within a few months.

People often miss this. They assume Medicare will adjust automatically. It won’t. You have to ask. And if you don’t, you could pay hundreds of dollars extra each month for no reason.

Low-income help is available

If your income is below the IRMAA threshold but still high enough to make premiums hard to afford, you might qualify for Medicare Savings Programs. These are state-run programs that help pay your Part B premium, Part D costs, or even your out-of-pocket expenses.Eligibility varies by state, but in 2026, the federal guidelines for the Qualified Medicare Beneficiary (QMB) program are:

- Single: income under $1,255/month

- Married couple: income under $1,693/month

These limits are higher in Alaska and Hawaii. If you qualify, Medicare will pay your premiums directly. You won’t get a check - your bill just disappears. You also won’t have to pay deductibles or copays for Medicare-covered services.

Apply through your state’s Medicaid office. Don’t assume you make too much - many people with modest savings or a small pension still qualify. The rules are more flexible than you think.

Prescription costs are tied to Part D premiums

IRMAA doesn’t just affect your doctor visits - it hits your prescription drug coverage too. If your income puts you in a higher IRMAA bracket, your Part D premium goes up. That’s on top of whatever your drug plan charges.For example, if you’re single and earn $140,000, your Part B premium jumps to $370. Your Part D premium could go from $12 to $31 a month. That’s an extra $228 a year just on prescriptions. For someone taking multiple medications, that adds up fast.

Some people switch to lower-cost drug plans to save money. But be careful. Cheaper plans might not cover your specific drugs, or they might have higher deductibles. Always check the formulary before switching.

What if you’re still working?

Many people keep working past 65. If you have employer coverage, you can delay signing up for Medicare Part B without penalty. But if you’re earning over the IRMAA threshold, you’ll still pay more once you enroll - even if you waited.There’s no way to avoid IRMAA if your income is high. The only way to dodge it is to reduce your taxable income before you turn 65. That means:

- Maxing out Roth IRA contributions

- Doing Roth conversions in low-income years

- Donating to charity to lower taxable income

- Delaying Social Security to reduce early withdrawals from retirement accounts

These moves require planning years in advance. If you’re already 65 and earning $150,000, it’s too late to change your 2024 tax return. But you can plan for 2027 and beyond.

Bottom line: there’s no free lunch

There’s no income level where you pay $0 for Medicare premiums. The lowest you can go is the standard rate - $185 for Part B. If you earn under $106,000 (single) or $212,000 (joint), you pay that. If you earn more, you pay more. And if your income dropped recently, you must appeal to get relief.Medicare isn’t designed to be free. It’s designed to be affordable - for most. If you’re in the top 10% of earners, you pay more. That’s the rule. But you’re not powerless. You can appeal, you can apply for state help, and you can plan ahead to avoid surprise bills.

Is there any way to avoid paying Medicare premiums entirely?

No. Everyone enrolled in Medicare Part B pays at least the standard premium of $185 per month in 2026. Even people with very low income pay something - though they may qualify for state programs that pay it for them. There is no legal way to opt out of paying if you want Medicare coverage.

Does Social Security count as income for Medicare premiums?

No, Social Security benefits themselves are not counted in the Modified Adjusted Gross Income used for Medicare IRMAA. But if you have other income - like investment earnings, pensions, or part-time work - that pushes your total above the threshold, you’ll pay more. It’s the total income, not Social Security, that matters.

Why does Medicare use my tax return from two years ago?

Medicare uses your tax return from two years prior because that’s the most recent data the IRS has available when premiums are set. So your 2024 income determines your 2026 premium. This delay helps Medicare avoid constant changes, but it can hurt people whose income drops suddenly. That’s why you can appeal if you have a life-changing event.

Can I reduce my Medicare premiums by changing my retirement withdrawals?

Yes, if you’re still working or haven’t started taking withdrawals yet. By delaying withdrawals from traditional IRAs or 401(k)s, or by converting to a Roth IRA in low-income years, you can lower your taxable income. This can help you stay under the IRMAA threshold. But once you’re already enrolled and your income is locked in, you can’t change past tax returns.

Do I pay IRMAA if I’m on Medicaid?

If you qualify for Medicaid, you’re likely also enrolled in a Medicare Savings Program. These programs pay your Part B and Part D premiums for you. So while IRMAA still applies, you won’t pay it out of pocket. Medicaid covers it. You don’t need to do anything extra - just make sure you’re enrolled in both programs.